Amerigo Vespucci, Italian explorer

Bill Graham, American concert promoter, The Fillmore, helicopter crash

Gary Cooper, actor, prostate cancer

Leon Trotsky, Russian revolutionary, writer, assassination

Robert Lowell, American Poet, heart attack

Stephen Jay Gould, American scientist, author “It’s a Wonderful Life”, lung cancer

George S. Patton, US Army General, complications auto accident

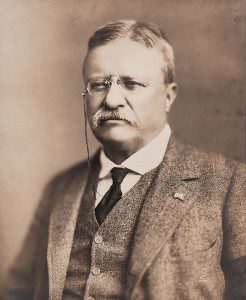

Theodore Roosevelt, 26th US President, writer, explorer, naturalist, blood clot lungs, January 6, 1919

Van Heflin, actor, heart attack

Syd Barrett, English musician, Pink Floyd, pancreatic cancer

Buddy Miles, US musician, congestive heart failure

Sergio Leone, Italian director, heart attack

Mahalia Jackson, gospel signer, heart failure, diabetes

Calvin Coolidge, 30th US President, coronary thrombosis

Walter Tetley, American voice actor, voice of Sherman in The Bullwinkle Show, after never fully recovering from motorcycle accident injuries

Jim Carroll, poet, musician, author “The Basketball Diaries”, heart attack

Peter Finch, British born Australian actor, heart attack

Bob Fosse, dancer/choreographer, heart attack

Amanda Blake, actress, Miss Kitty on Gunsmoke, AIDS

James J. Kilroy, shipyard inspector “Kilroy was here”

Anthony Perkins, actor, AIDS

Benedict Arnold, turncoat general American Revolutionary War, dropsy

Susan Strasberg, actress breast cancer, along with 10 other notables due to breast cancer

Winthrop Rockefeller, governor Arkansas, cancer of the pancreas

Murray “the K” Kaufman, New York City disc jockey, cancer

R. J. Reynolds, III, emphysema

Allison Doupe, American neuroscientist, cancer

John J. McGraw, baseball player and manager NY Giants

Shemp Howard, actor and comedian, the Three Stooges, heart attack

Tom Mix, American Actor, car accident

Peter Grant, English, manager Led Zeppelin, heart attack

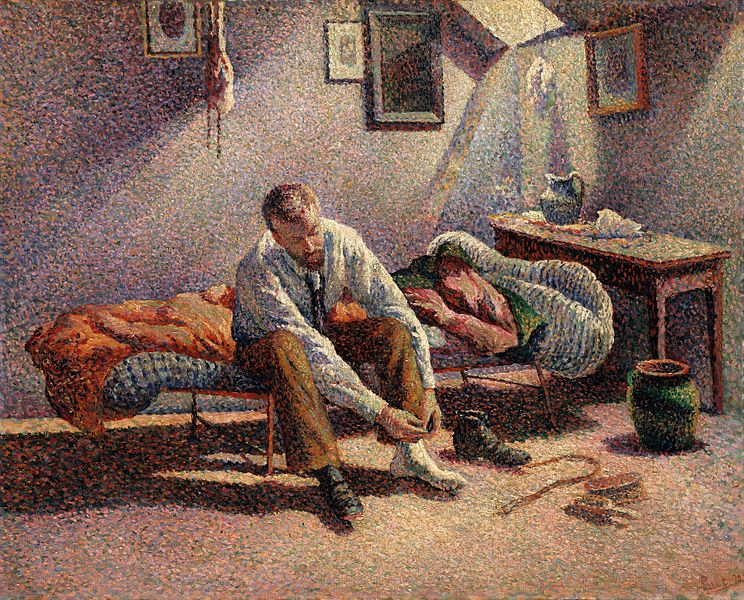

John Constable, British artist, apparently heart failure