Findlaw.com has a useful estate planning checklist which is from the American Bar Association. This checklist asks for the basics of life insurance policies: company name, address, policy number, owner, beneficiaries, etc. What’s missing from the checklist is method of payment. It ought to be included. Provide information as whether the policy is on bank draft or direct billing, and provide information on the billing cycle. Many problems occur with life insurance policies on bank drafts being rejected for insufficient funds, or direct bills, mostly quarterly or annual, not being paid. Life insurance policies have by law a 30 day grace period for past due payments. If a permanent policy has cash value and an automatic loan provision, the policy can draw off its cash value and remain in force.

If you don’t know the policy number, most companies reference life policies by the insured’s social security number. I found it rather curious omission that this checklist didn’t ask for social security numbers. It’s can be very useful for tracking down a life policy.

postscript 9/12/2011: (emphasis mine)

But 57 percent of the policy owners who have talked to the beneficiaries about the existence of the policy admitted that they have not told the beneficiaries where the policy is located.

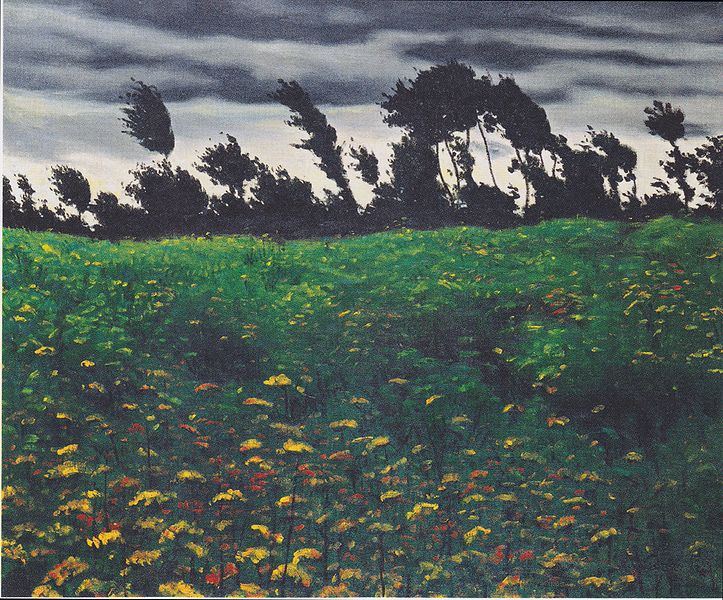

Image source: Wikipedia Commons