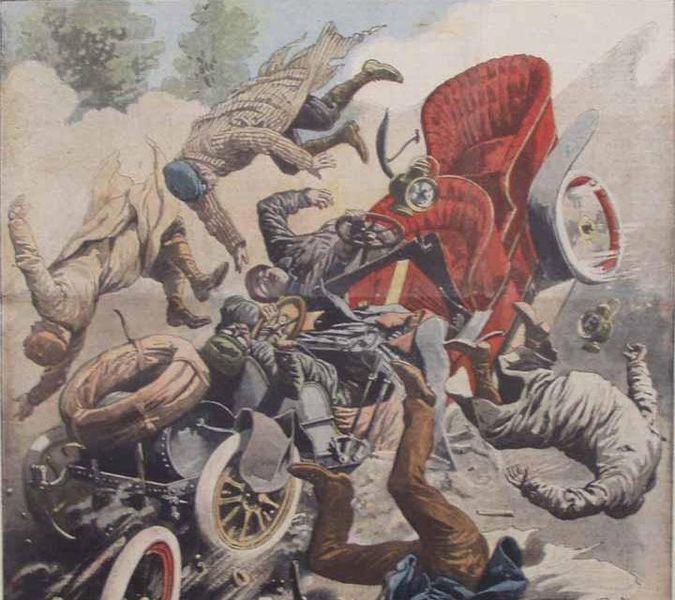

As a mater of course permanent life insurance coverage now offers either a Long Term Care (LTC) benefit or what is called a Chronic Illness Benefit. Their features are about the same, but the major weakness of Chronic Care riders has been that the condition had be expected to be permanent. Many conceivable LTC occurrences, involving the loss of 2 out of the 6 activities of daily living, are temporary and recoverable, for example with a major auto accident, a broken hip or a moderate to severe stroke.

AIG group announced that “thanks to a recent change in accelerated benefit regulations; which allowed the permanency requirement to be removed from chronic illness riders” that American General Life with their Chronic Illness Rider will allow non permanent conditions. That’s a huge benefit enhancement! Well done AIG for pioneering this expanded benefit. I wonder how many other carriers will follow suit and broaden their definitions of chronic care to allow recoverable condtions.

Being HIV-positive used to be an automatic decline for life insurance except for guaranteed acceptance products. HIV-positive people now may be able to qualify for life insurance through Prudential and John Hancock. Prudential offers 10 and 15 year term.

Being HIV-positive used to be an automatic decline for life insurance except for guaranteed acceptance products. HIV-positive people now may be able to qualify for life insurance through Prudential and John Hancock. Prudential offers 10 and 15 year term.