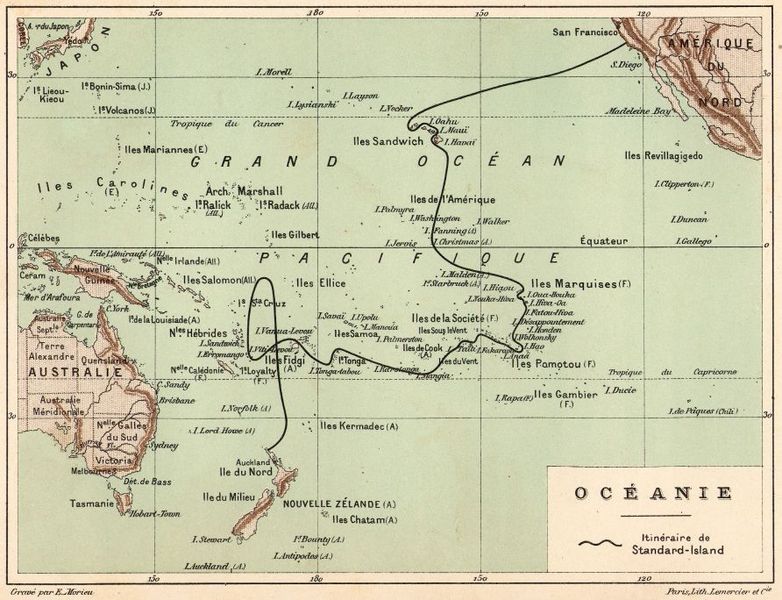

Think of IUL as a means to achieve desired goals: to build cash value and to provide a death benefit. It is like going by yacht across the Pacific from California to Tahiti. This is a long journey, under many weather conditions, and this vessel is particularly designed to be safe and to reach its destination.

Prior to this life insurance that captured stock market, equity, returns was a more perilous journey. Variable Universal Life, a VUL class yacht, was favored. It is a sleek craft with the potential of performing very well (direct stock market participation), but like a yacht without an engine, it has proved to be risky for loss of cargo (cash value) and to capsize and sink (lapse).

So along came Indexed Universal Life as a safer alternative. It is like a powered yacht. Call it a IUL class yacht. She is backed by the ship builder (carrier) with no direct participation in the stock market. She has a sail or multiple sails (Index Account). Sails are designed for use when the winds are favorable (bull market) to build up the cargo (cash value) and ship’s value (death benefit). If there is a typhoon (bear market) approaching, the ship’s owner can use the engine instead (Fixed Account). If there are varying winds or doldrums, the owner may use both sail and engine (Participation Rate). The owner must decide in advance which mode to use for a period of time (Segment). This segment is generally one year. When the segment is over, the yacht owner is awarded for its performance (Interest Rate Crediting ) that increases the value of the cargo (cash value) and yacht (death benefit).

Now this IUL yacht has a very sturdy deck (Floor). Generally this deck is totally protected against leakage (0% market losses). It may even a raised deck (1% or higher Floor). As with a double hull, there are also guarantees in place for the ship not to sink (lapse). These guarantees may be for a set period of time like 10 years, 20 years or for life.

There are, however, certain restrictions placed on the ship’s speed in favorable conditions. The height of the mast is limited by the ship builder (Cap) or the top mast lowered (Spread). The yacht owner may gain extra by increasing the volume of sail (additional premiums). There are however certain rules as to how much sail is permitted (IRS rules for Modified Endowment Contract or MEC).

With an Indexed Universal Life cash value is built higher by increased premium contributions, and by gauging the direction stock market performance. Ideally, when the market is in an upward trend, the owner has directed premium into a high performing index, and when the market is in a downward trend, premium is directed into a fixed account. Regardless of choice or performance, the policy is protected against any losses by the floor. It is similar to a powered yacht that sets the maximum amount of sail with favorable winds, and uses the engine when conditions are unfavorable. There are various possible coverage goals. Some may use an IUL for early cash value accumulation for retirement, others can use the cash value for premium payments in retirement and estate planning.

Keep in mind when reviewing Indexed UL products

Just as yacht makers may brag about the boat’s sails, engine and design, life insurance carriers will promote their Cap (e.g. 13%), Fixed Account guarantee (e.g. 3%), Floor guarantee (e.g. 1%) and other bonus features. What is not evident is the product’s cost of insurance, expense and policy charges, the ship’s drag, how that affects the performance over a long period of time, especially 20, 30 or 40 years out.

How to Evaluate Competing Indexed UL Products

Fortunately, you don’t have to buy this IUL yacht after just reading the specs and trusting that it sails well. Request from the agent a policy illustration to test the product’s projected future performance. This will simulate how load and expense charges affect policy values, and compare that side-by-side with other carriers. This will help determine the all important internal rate of return. It’s similar to computer modeling a yacht race factoring each boat’s design, tonnage and various wind conditions. The carrier’s financial strength and viability is another important consideration because cost of insurance and other expense charges are subject to change, and you are also selecting which carrier will perform best and deliver the best results over time.

Sean Drummey

Sean Drummey

Contact for a free quote

Phone: (910) 328-0447

Email: spdrummey@gmail.com

Continue reading “Indexed Universal Life (IUL) compared to a ship’s journey”