My American consumers evidently have a limited understanding of life insurance, but life insurance is really not all that difficult. A competent agent can explain the basics in a few minutes. Most people need term life insurance which for most is inexpensive and has a fixed rate for decades. For example age 50, $250,000, 10 year term is $21.12 a month at preferred plus and $38.35 a month at standard; age 60, $250,000, 10 year term is $43.09 at preferred plus and $75.38 a standard.

It boils down to recognizing the need for coverage. Does someone depend on your income? What would happen to your children or spouse if you died? What are your family’s needs for estate planning?

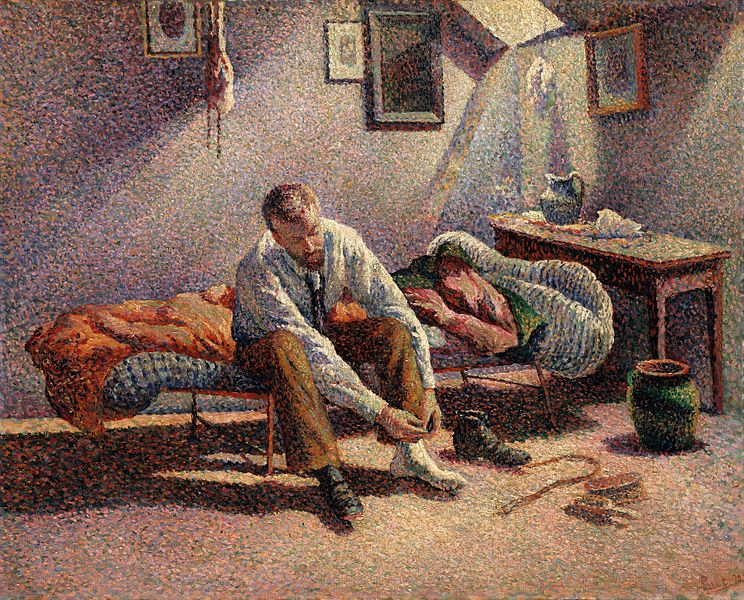

It’s hard to consider one’s own death, but that becomes easier as you get older because people you know start dying. This usually starts in high school and accelerates in your 40’s and 50’s.

Applying for life insurance, even if you regularly see a doctor, gives you a broader understanding of your health. Life insurance, fully underwritten, the least expensive kind, requires a blood test and often a review of medical records, all at no cost to the applicant. The carrier then determines a risk classification: preferred best, preferred, standard plus, standard or substandard. It’s objective with measurable criteria. That decision can be very revealing because often doctors do not adequately inform patients of their risk, and people often do not know or adequately understand the state of their health.